A deep-dive on Pyramid Technoplast (long thread)

Before we begin, the necessary disclosures. I’m personally invested in the business, therefore please consider all future text as biased. This is a purely educational thread to help you understand the IBC container space & thesis building around catalysts and is NOT a recommendation.

Standard disclaimer: https://www.gsninvest.com/standard-disclaimer.

This will be a long post, so keep a cup of coffee or hot chocolate (we don’t judge!) handy! ☕

The proverbial loaded spring is what we all look for while investing - a business that has put in the work to compress the spring, and is now ready to launch - converting all the potential to kinetic energy! The business we will study today, appears to be a similar loaded spring!

Before we begin, it is helpful to understand some key concepts.

Proxy investing: When you invest in a key supplier or intermediary catering to a growing industry, so that you benefit from broader industry growth no matter who wins in the industry. These businesses also tend to get higher multiples with time as investors wanting a safe way to play a theme flock to it. (1)

Consumables: Items that need to be purchased afresh every time instead of a one time purchase (think printer ink or razor blades). This helps because there is more stability and lower cyclicity in demand in such products- this not only helps business fundamentals but also the multiples businesses can get. (2)

Fixed asset turns: Fixed asset turns is the amount of revenue you can generate for every rupee of fixed assets you own. A high fixed asset turns allows for businesses to scale revenue fast even off a smaller investment in capex, and allows capex to be fully (or largely) funded by internal accruals - which is great for balance sheet stability. In India, the government also provides subsidies on investments made, making the actual fixed asset turns even higher than reported numbers! (3)

Proximity driven moat: In items where the cost of the item is low, but volume and therefore cost of logistics is high, proximity ends up being a significant moat. This moat is further strengthened as the business reaches efficient scale by catering to most clients in that geography developing a further moat on cost competitiveness. (4)

With the basics covered, let’s now dive into the business.

Pyramid Technoplast is a leading manufacturer of polymer drums, intermediate bulk containers and metal drums in India. These containers are used for storage and transportation of chemicals and agrochemicals - and Pyramid caters to many marquee clients including Deepak Nitrite, Patanjali, Adani Wilmar, Asian Paints, GACL, and Alkyl Amines

.

It is focused in West India, with plants around key clients it supplies to - and with a bulk of India’s chemical exports coming out of Gujarat the business has 7 manufacturing facilities in Silvasa and Bharuch, and an 8th now operational in Maharashtra.

Unit 1- Silvasa 7488 MTPA

Unit 2- Silvasa 4083 MTPA

Unit 3- Bharuch 6694 MTPA

Unit 4- Bharuch 7000 MTPA

Unit 5-Bharuch 210,000 units

Unit 6- Bharuch 10,800 MTPA (Metal drum capacity increased from 50K to 90K units)

Unit 7- Bharuch 120,000 units; 5499 MTPA

Unit 8 - Maharashtra (New plant, now operational)

Unit 9 - Recycling Unit (Now operational)

+

Captive solar plant (10cr annual power savings; Guj plant operational in Oct)

Industrial storage and transport is a natural proxy to this growing chemical industry, and being largely volumes driven is relatively better protected against the vagaries of pricing pressures that subsectors might face. (ref 1: proxy investing) While the Indian chemical industry has gone through a rough couple of quarters - in the long run, this continues to be a sunrise sector (in part because of the capabilities that Indian companies have built, but also because of the NIMBY (not in my backyard) nature of certain chemical businesses).

The industry has a natural proximity driven moat due to the high volume low value nature of containers which will keep international competition at bay. Strong domestic players located strategically close to the manufacturers are therefore bound to benefit driving a stable oligopolistic structure in the business. (ref 4: proximity driven moats)

IBCs also act like a consumable for the sector, because their low value high volume drives single use in most instances. Channel checks suggest IBC containers at destination are usually given off for recycling or scrappage. We like consumable businesses because unlike capex driven proxies to the chemical sector the demand here is less cyclical and more steady. (ref 2: consumables)

With the business now well understood, let’s move on to understanding what makes the business a loaded spring!

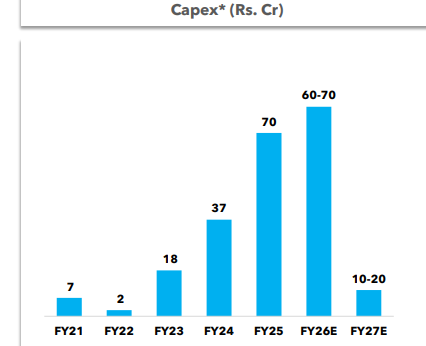

1. Heavy capex over the last 8 quarters:

Between FY21 to 23: 27cr

FY24: 37cr

FY25: 70cr

FY26E: ~70cr (of which ~40+ has already been deployed in Q1)

Important to note here that the business enjoys a 5x+ fixed asset turns, which drives a strong revenue potential of 900-1000cr as this capex goes upstream and starts getting utilized. A key point here is that the business also gets subsidies over a 10yr period (~30cr on a 50cr project), so actual payback periods and IRRs are actually (materially) better than reported numbers.

2. Multiple margin levers:

While the capacity built would drive good revenue growth, the business is also pushing the gas on margin levers

Solar: The captive solar plant that we discussed above will be the first margin growth lever, saving upto 10cr annually in power costs. The solar project is currently financed with low cost debt (8.5%), which the business plans to pare down starting FY27

.

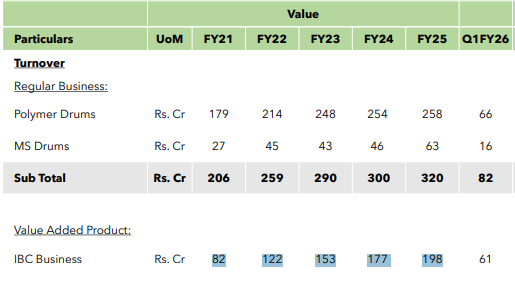

Mix: The business is also having an increased IBC container mix, which operates at a 12-14% operating margin vs the mid single digit margin numbers for the plastic and steel drum segments

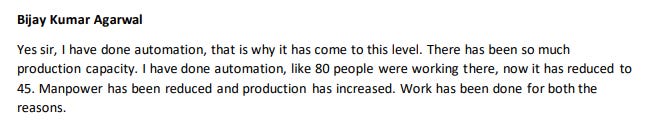

Automation: Labour is a key operating cost for the business. The business has now ramped up automation in the metal drum plant, which should help move margins of that segment towards higher single digits. A lot of the competition in the segment is also unorganized, so better costing also helps the business crush competition.

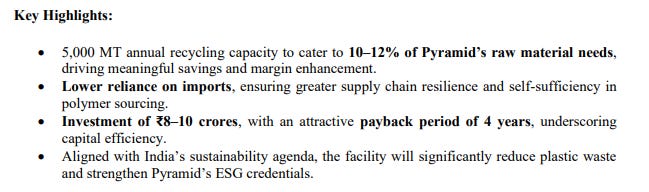

Recycling: Unit 9, which is the recycling plant of the business will help save costs on RM (10-12% volumes can be catered to via the recycling unit), while also reducing import dependence.

More importantly most if not all of these levers should be visible starting as early as Q3.

Macro kicker:

Pretty much every problem on the macro front that could have impacted the business - has. Chemicals, one of the key end markets for the business has gone through a downcycle - that now changes. PET prices, a key raw material has bottomed out at ~Rs90 - since the business effectively levies a conversion charge on PET, weak and falling PET prices have not reflected in revenue growth, even as volumes have growth. These levers macro levers, impact the business both optically (pace of revenue growth appears faster) as well as fundamentally (new capacity can be utilized faster as sector recovers.)

That being said, no thesis is without risks. So here goes.

Continued weakness in the end market: The business is heavily dependent on agri-chemicals, specialty chemicals and generic chemical businesses. Although there might be challenges in the space from time to time, long term the Indian chemical space is poised to grow well. Therefore this is likely to be a persistent short term risk, but not a major risk from a long term perspective.

Supply chain risks: Around 60% of the raw materials the business consumes are imported from countries like Kuwait, Qatar, Saudi Arabia, Oman and Singapore. Both of the primary raw materials in the business - polyethylene and polypropylene are crude derivatives and hence face a commodity price risk. Any material shortage or interruption in the domestic and international supply or decrease in the quality of raw materials due to natural causes or other factors could result in increased production costs that the company might not be able to pass on to end customers. However historically the business has been able to manage margins in a very tight range.

If you’re interested in reading our detailed initiating coverage report on Pyramid along with reports on other businesses (25+ closed reports, all active coverage and 8-12 new fundamental recommendations every year), you can join us here

Premium Research: https://bit.ly/joingsnra [This is ideal for investors with 20L+ in equities looking for focused fundamental research]